RAFITM Harvey

GS Index

The Power of Collaboration

Professor Campbell Harvey’s extensive body of work across yield curve dynamics, commodity factors, equity momentum turning points, and risk timing is now accessible, in collaboration with Research Affiliates and Goldman Sachs, through the development of the RAFI Harvey GS Index.

Research Affiliates is a global leader in equity portfolio design, managing over $159 billion in AUM (as of 6/30/25) and a legacy of over 400 published works, including 293 publications and 154 research papers.

Goldman Sachs, a leading global financial institution founded in 1869, provides services to corporations, institutions, governments, and individuals. Headquartered in New York, it operates in major financial centers worldwide, excelling in research and trading for over 150 years.

Campbell Harvey, PhD

Partner & Director of Research at Research Affiliates

Duke Professor and globally recognized researcher on the yield curve as a recession indicator, momentum strategies, and risk management.

An Opportunity for Growth Supported by Academic Research

The RAFI Harvey GS Index (the “Index”) is a multi-asset investment strategy that blends equity indices with bond and commodity futures. It combines equity strategies devised by Research Affiliates and decades of research from Professor Campbell Harvey. Designed to shift allocations between growth and value equity, while switching to a defensive position in periods of market downturns, the Index features:

Broad Diversification

- The Index leverages a combination of growth and value equities, bonds and commodities to offer a broad range of assets for diversification.

Equity Market Adaptive Switching

- Using an adaptive switching strategy, the Index shifts between growth and value equities based on short- and long-term momentum signals.

Dynamic Multi-Asset Allocation

- Developed in collaboration with Professor Harvey, the Index dynamically allocates between equities, bonds and commodities seeking to achieve more consistent growth and control downside risk.

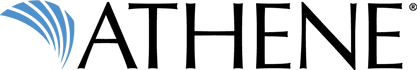

Harvey’s Adaptive Switching Strategy Based on Momentum Signals

The Index utilizes an adaptive strategy to dynamically switch allocations between growth and value equities. Aiming to create a balance between reacting too quickly to market shifts and avoiding false signals caused by noise, the Index analyzes momentum signals over six- and twelve-month horizons and adjusts allocations accordingly.

Equity Market Adaptive Switching

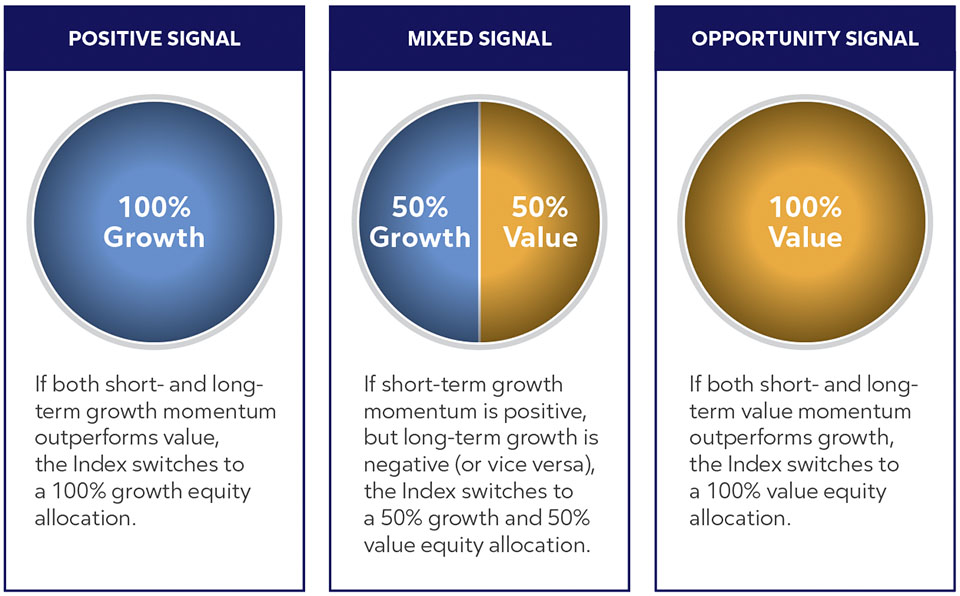

Dynamic Multi-Asset Allocation Leveraging Harvey’s Research

Based on Professor Harvey’s extensive research on market factors, the Index dynamically allocates between equities, bonds and commodities. This approach seeks to achieve returns by switching between growth and value equities based on market signals, including assets to diversify and employing downside management techniques developed by Research Affiliates.

Dynamic Multi-Asset Allocation*

The Index seeks to limit downside risk by dynamically adjusting the exposure to equities. Additionally, the Index seeks to maintain a 5% annualized volatility target to help manage risk while markets are volatile. While this may lessen the impact of market downturns, it may also limit upside potential.

*The diagram illustrates the initial allocation prior to dynamic risk allocation and volatility control adjustments. The exact weights in each asset class will vary over time according to Index rules.

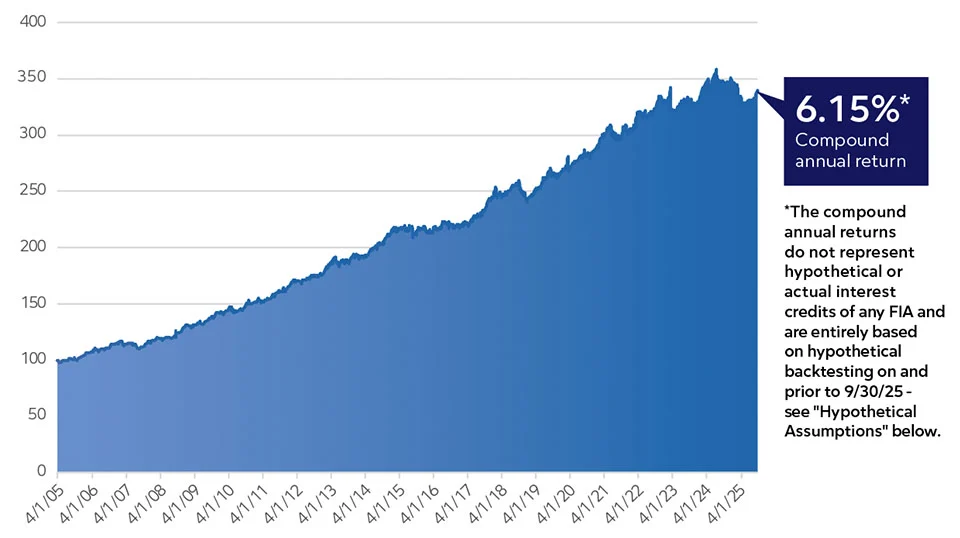

Designed to Achieve Stable and Consistent Returns

The RAFI Harvey GS Index would have provided consistent growth across different market conditions. Its ability to achieve this stability comes from its research-driven strategies and innovative approach. The graph below illustrates actual and back-tested performance of the Index.

RAFI Harvey GS Index Performance

(backtested prior to 9/30/25).

*Hypothetical Assumptions: Back-tested performance of the RAFI Harvey GS Index (the “Index”) from 4/1/05 to 9/30/25. The Index was established on 9/30/25. Back-tested performance is for illustrative purposes only. There is no assurance or guarantee that the Index will operate or would have operated in the past in a manner consistent with the back-tested performance. Such simulated performance data has been produced by the retroactive application of a back-tested methodology and may reflect a bias towards strategies that have performed well in the past. You should carefully consider the assumptions, limitations and potential biases of the back-testing process when evaluating any hypothetical performance data. No future performance of the Index can be predicted based on the simulated performance or the historical returns described herein. Performance figures are net of servicing costs (based on notional positions) and rebalancing costs (based on turnover). For more information about the Index, including certain assumptions underlying backtested performance and costs, see the Index Methodology and other materials available at https://www.goldmansachsindices.com/products/RAHARVEY. The foregoing performance information does not include any relevant costs, participation rates, and charges associated with the product.

The RAFI Harvey GS Index is available with Athene Velocity. Rates and product availability will vary by state and results may be higher or lower. For more information on Athene Velocity with the Index, ask your insurance professional for an illustration.