MSCI MKT MediaStats Multi-Asset Index

Leveraging Financial Narratives and Proven Research

Research in financial economics suggests a strong correlation between media coverage of economic narratives and asset returns. By analyzing this research, the team at MKT MediaStats identified key indicators that inspired the construction of the MSCI MKT MediaStats Multi-Asset Index.

An Opportunity to Capture Momentum from Media Narratives

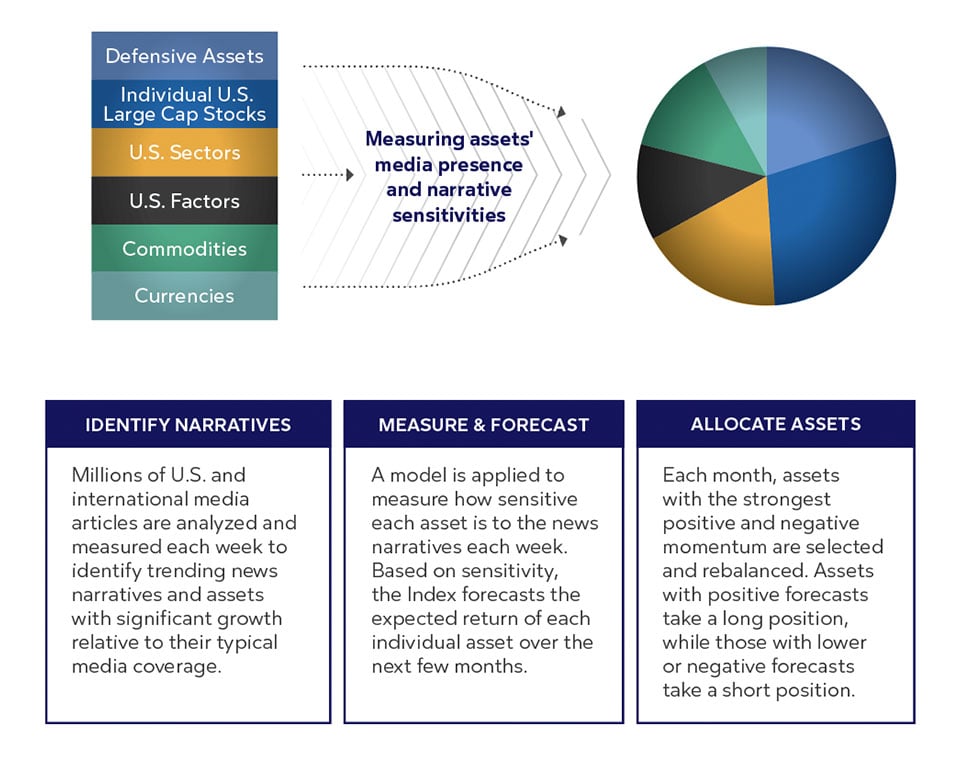

The MSCI MKT MediaStats Multi-Asset Index was designed to predict asset returns within multiple asset classes by evaluating millions of articles pertaining to evergreen narratives daily. The Index is based on three core principles:

Broad Diversification

- To help provide greater growth opportunities and the flexibility to adapt to a variety of markets, the Index provides exposure to six asset classes to offer a broad range of assets for diversification.

Changing Attention to Media Narratives

- Media attention can influence markets and investors tend to underreact or overreact. The Index measures each asset’s sensitivity to the news narratives to help determine which assets it is going to select.

Narrative Momentum Driven Asset Allocation

- The Index forecasts the return of each asset based on the momentum of news coverage and strategically allocates to assets expected to perform well going forward with the aim of capturing returns through changing markets.

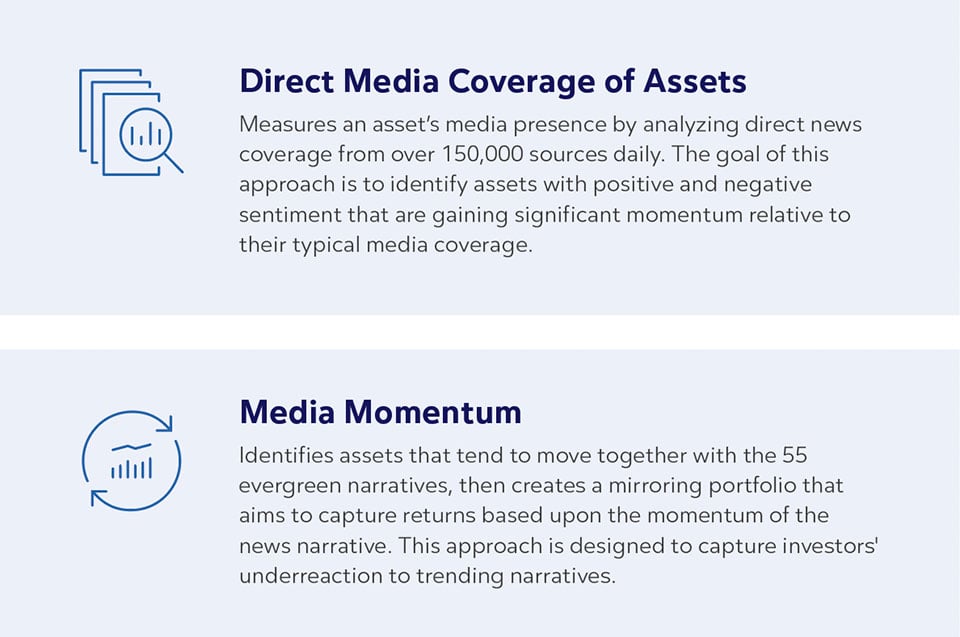

Strategies Designed to Identify Narrative-Sensitive Assets

Leveraging MKT MediaStats’ research in financial economics, the Index applies strategies designed to capture momentum from news narrative sensitive assets and aims to generate positive returns. These strategies are broadly categorized into two groups:

Applying News Narrative Driven Strategies

The Index applies the strategies to help identify strong news narratives in the market and capture momentum of those trends. On a monthly basis, the Index is rebalanced with the aim to achieve optimal risk adjusted returns.

Additionally, the Index applies an excess return dynamic daily risk control overlay to help stabilize returns. If daily volatility falls below 8%, the Index may increase its allocation to the selected asset classes up to 250%. If daily volatility is greater than 8%, exposure can be reduced below 100%.

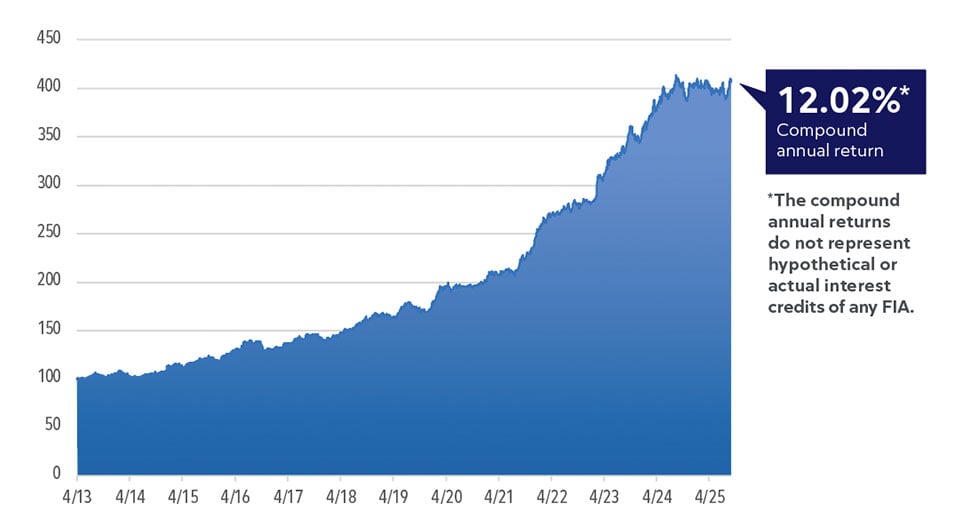

Designed to Capture Growth from Evolving Media Narratives

The MSCI MKT MediaStats Multi-Asset Index would have provided relatively consistent growth through various markets. The Index’s research-backed strategies and momentum-driven asset allocation are designed to capture narrative momentum and outperform the broader market. The graph below illustrates actual and back-tested performance of the Index.

MSCI MKT MediaStats Multi-Asset Index Performance

*Hypothetical Assumptions: Index value of the MSCI MKT MediaStats Multi-Asset Index from 4/30/13 to 9/30/25. The Index was established on 9/29/2025. Performance shown before this date is back-tested by applying the index strategy, which was designed with the benefit of hindsight, to historical financial data. Back-tested performance is hypothetical and has been provided for informational purposes only. Past performance is not indicative of nor does it guarantee future performance. The foregoing performance information does not include any relevant costs, participation rates, and charges associated with the product or the Index.

The MSCI MKT MediaStats Multi-Asset Index is available with Athene Velocity. Rates and product availability will vary by state and results may be higher or lower. For more information on Athene Velocity with the Index, ask your insurance professional for an illustration.